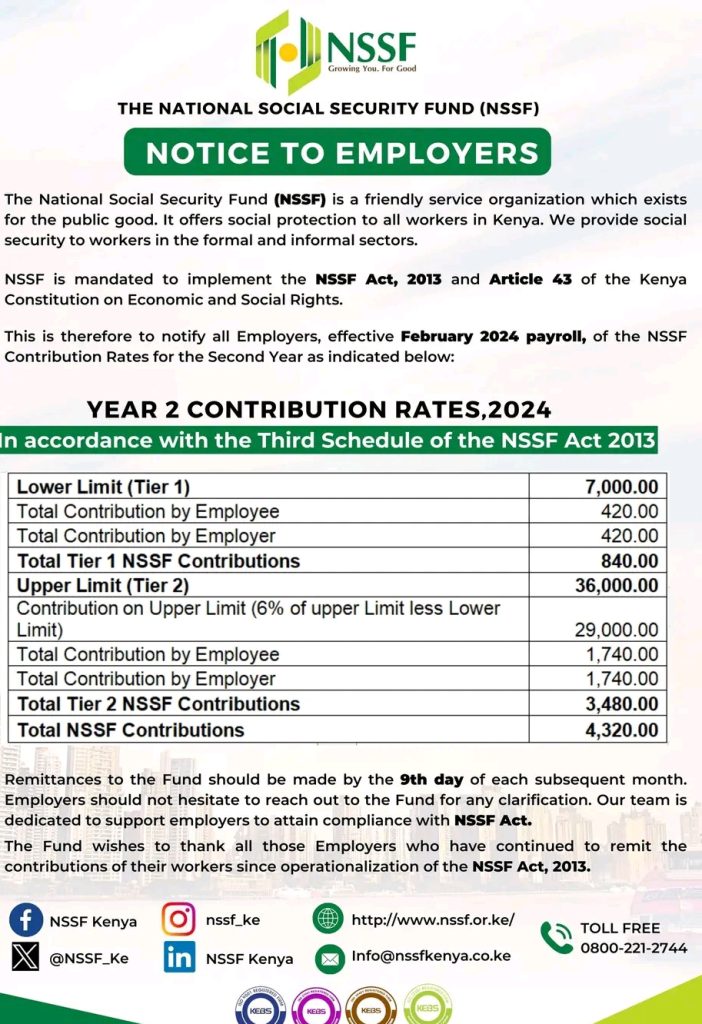

A recent notice from the National Social Security Fund (NSSF) has outlined changes to employee deductions on payslips. The Lower Earnings Limit has risen to Sh7,000, resulting in a contribution increase from Sh360 to Sh420 for qualifying employees.

Simultaneously, the Upper Earnings Limit has jumped to Sh29,000, leading to a rise in contributions from Sh1,080 to Sh1,740 for most workers. This adjustment, approved by the Court of Appeal in September 2022, mandates employers to match each contribution. The new rates will persist until the next review in January 2025, part of a gradual five-year increase initiated in 2023.

In a recent development, the National Social Security Fund (NSSF) has issued a notice outlining significant changes to employee deductions on upcoming payslips. According to the announcement, employers are now required to deduct amounts ranging from Sh420 to Sh1,740 from their employees’ pay-slips.

The Lower Earnings Limit, representing the lowest pensionable salary, has been raised from Sh6,000 to Sh7,000. Consequently, employees falling into this category will now contribute Sh420, up from the previous Sh360.

Simultaneously, the Upper Earnings Limit has undergone a substantial increase, climbing to Sh29,000 from the previous Sh18,000. This adjustment means that a majority of workers will see their contributions rise from Sh1,080 to Sh1,740.

The green light for these deductions came from a Court of Appeal judgement in September 2022. As per the established norm, each employee’s contribution will be matched by their employer. These rates are slated to remain in effect until the next review scheduled for January 2025.

Initiated last year, this new deduction plan is set to gradually increase rates over a five-year period. This change in contribution structure traces back to 2013 when the NSSF Act came into effect, mandating a six percent contribution from eligible employees.